When it comes to fuel cards that offer unbeatable discounts, our Business Fleet Solutions’ Fuel Card is top-tier. This card boasts an outstanding rebate program, enabling significant savings on your fuel expenses just like finding a hidden treasure. In addition, other potent contenders in the market include Shell Fleet Plus Card, ExxonMobil Business Fleet Card, and WEX Fuel Card, each coming with unique rebates and incentives. It’s about spotting those perk-loaded opportunities and reaping maximum benefits from your fuel purchases. Now onto the fascinating features of these reward-based fuel cards…

Fuel cards with rewards and rebates provide businesses with cost-saving opportunities through cashback, discounts, or points earned on fuel purchases. These incentives can help manage expenses, improve fuel efficiency, and contribute to overall savings for commercial fleets.

Top Fuel Cards Offering Rebates

When it comes to managing business expenses, every penny saved counts. Fuel costs are a significant part of any business that relies on transportation, and using fuel cards with lucrative rebate programs can drastically reduce these expenses. Let’s take a closer look at some of the top industry-leading fuel cards that offer robust rebate structures and benefits.

First up, the “Business Fuel Card” offered by Business Fleet Solutions is designed to provide businesses with significant savings on fuel expenses through a competitive rebate program. This card is tailored to meet the unique needs of businesses and offers a streamlined approach to managing fuel costs. The robust rebate program not only helps in reducing overall fuel expenditure but also provides valuable insights into fuel consumption, enabling businesses to make informed decisions about their fleet operations.

Shell Fleet Plus Card

Moving on to the Shell Fleet Plus Card, this option provides businesses with an ongoing rebate schedule and personalized, data-driven insights to effectively manage fuel expenses. The card offers savings of up to 6 cents per gallon through its rebate program, allowing businesses to make substantial cost savings on their fuel purchases. With acceptance at nearly 13,000 Shell stations and participating Jiffy Lube locations nationwide, the Shell Fleet Plus card provides a convenient and cost-effective solution for businesses.

ExxonMobil Business Fleet Card

Next in line is the ExxonMobil Business Fleet Card, which offers businesses a comprehensive fuel management solution with a focus on cost savings and efficiency. The card provides users with ongoing discounts and rebates, contributing to significant reductions in fuel expenses. By leveraging the rebate structures offered by the ExxonMobil Business Fleet Card, businesses can optimize their operational costs and enhance their bottom line.

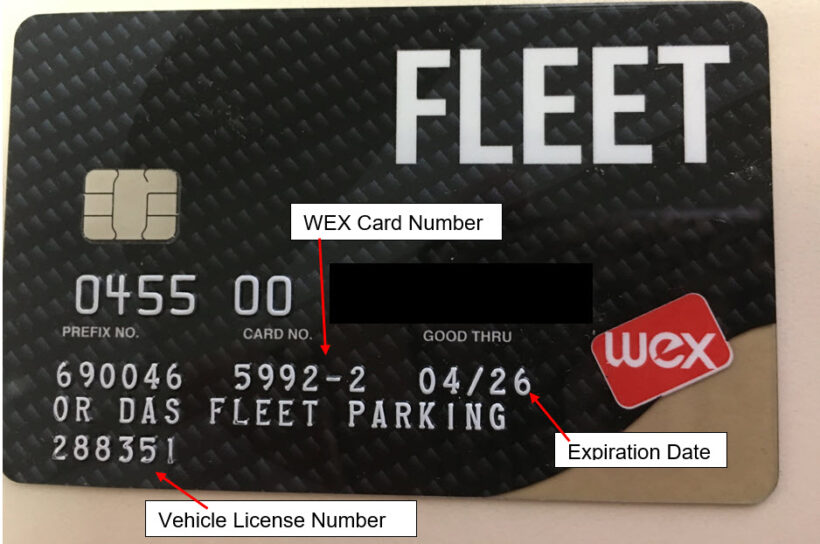

WEX Fuel Card

Finally, the WEX Fuel Card is another notable player in the industry that delivers extensive rebate structures and benefits to businesses. With its emphasis on providing tailored solutions for fleet management, the WEX Fuel Card offers distinct features that contribute to substantial savings on fuel expenditures. By utilizing the rebate program offered by the WEX Fuel Card, businesses can gain valuable insights into their fuel usage patterns and access cost-effective fueling options across a wide network of locations.

Overall, exploring these leading options in the realm of fuel cards with rebate programs presents businesses with opportunities to maximize discounts and realize significant cost savings on their fuel expenses. Each of these industry-leading fuel cards comes equipped with unique features designed to cater to the diverse needs of businesses while offering substantial rebates and rewards that contribute to overall operational efficiency.

Having covered these top contenders in the realm of fuel cards offering rebates and rewards, it’s important for businesses to carefully assess their specific requirements and choose a fuel card that aligns with their operational needs and long-term cost-saving objectives.

Features of Reward-Based Fuel Cards

Reward-based fuel cards are akin to having a secret treasure chest for your fuel purchases. It’s not merely about buying gas; it’s also about getting something back for it. It’s like going to the arcade and earning tickets for every game you play—eventually, you’ll have enough tickets to claim a cool prize.

Some reward-based fuel cards provide cash back as a percentage of the money spent on fuel. Imagine filling up your tank and then a little bit of that money finding its way back to you. It’s like scoring a small win every time you get gas.

Other cards offer discounts at particular gas stations, meaning you could pay less than others for the same amount of gas. Think of it like getting a discount on something just because you have a special card in your wallet.

Points-based reward systems are also popular with these types of cards. You earn points with every fuel purchase, and then those points can be redeemed for things like free fuel, travel, or even merchandise. It’s like taking a road trip and earning free stays at hotels along the way.

The Perks in Detail

Offered through loyalty programs, these perks could end up saving you hundreds each year:

- Cash Back: A percentage of each purchase is given back in cash.

- Discounts: Special pricing at participating gas stations.

- Points Programs: Earning points with each purchase that can be redeemed for various rewards.

For example, let’s say you used a reward-based fuel card and filled up your car five times in a month, spending $50 each time. If your card gives 5% cash back on fuel purchases, that’s $12.50 coming back to you over the month—enough for a meal at your favorite restaurant.

The idea behind these features is simple: it’s like saying thank you to loyal customers who come back again and again. Having these little bonuses definitely makes our efforts feel appreciated.

So, whether it’s saving money, earning points toward travel plans, or simply enjoying the feeling of being appreciated as a customer, reward-based fuel cards certainly pack quite a punch when it comes to benefits for frequent fuel purchasers.

With an understanding of the value-packed into reward-based fuel cards, let’s now turn our attention to unraveling how discounts work when using specific fuel cards.

How Discounts on Gasoline Work

Fuel cards can be a game-changer when it comes to buying gasoline. Imagine saving money on every gallon you pump into your vehicle just because you have a certain card in your wallet! It almost sounds too good to be true, right? Well, let’s break it down and see exactly how this magic happens.

Cash Back or Rebates: Many fuel cards offer cash back or rebates based on the amount of fuel purchased within a billing cycle. This means that the more fuel you buy, the more money you get back in your pocket. It’s like getting rewarded for doing something you were already going to do—pretty neat, isn’t it? These savings can really add up over time, especially for businesses with a fleet of vehicles where fuel expenses are substantial.

Let’s say your business has been using Shell Fleet Cards. With these cards, you can earn ongoing savings based on the number of gallons purchased in a billing cycle. Over time, these rebates can have a significant impact on your overall fuel costs, potentially leading to substantial savings at the end of the year.

Partner Fuel Stations Discounts: In addition to rebates, some fuel cards also provide discounts at specific partner fuel stations. This means that using a particular fuel card at select partner stations will make each gallon of fuel cost less. These kinds of partnerships can lead to additional savings on top of the regular rebates offered by the card itself.

For example: Imagine having a card that provides an extra discount of a few cents per gallon at a major chain of fuel stations. When combined with the cash back or rebates from using the card itself, the savings start to really add up.

With discounts from both the card provider and partner stations, using a fuel card can help businesses and individuals save money on one of their most essential expenses—fuel for their vehicles.

So as you can see, these discounts aren’t just about pinching pennies; they’re major money-saving opportunities for anyone who relies on fuel for their daily operations.

Choosing an Optimal Fuel Card

Selecting the right fuel card for your business is a crucial step that can result in substantial savings and benefits. However, with numerous options available, it can be overwhelming to figure out which one will suit your specific needs. Let’s break down the key factors to consider when choosing an optimal fuel card.

Acceptance Network

One of the primary considerations is the acceptance network of the fuel card. A wide and expansive network means that you’ll have more options and flexibility when it comes to fueling up, offering convenience and accessibility for your drivers.

Available Rebates and Rewards

The potential rebates and rewards offered by a fuel card can significantly impact your overall savings. Look for a card that provides ongoing savings based on the number of gallons purchased in a billing cycle. Additionally, some cards offer discounts at participating partner locations, such as Jiffy Lube, providing additional value beyond fuel purchases.

It’s like getting a bit of extra money back every time you fill up, or saving on other maintenance expenses for your fleet vehicles. These rebates can quickly add up to significant savings for your business over time.

Associated Fees

While some fuel cards come with no associated fees, others may have certain costs or charges. It’s crucial to carefully review the fee structure of each card, including any potential transaction fees, monthly statement fees, or account setup fees. Understanding these costs upfront will help you evaluate the true value that each card offers.

Alignment with Business Needs

The ideal fuel card should seamlessly align with the specific fueling requirements and budget of your business. Consider factors such as your typical monthly fueling volume, preferred fueling locations, and the mix of vehicles in your fleet. By understanding your unique needs, you can select a card that provides maximum value in terms of rewards and rebates.

Some businesses might be attracted to flashy rewards but might overlook whether these rewards are actually relevant to their specific needs. It’s important to choose a card based on actual practical value rather than just being swayed by enticing but ultimately unnecessary benefits.

Choosing an optimal fuel card is more than just picking a piece of plastic; it’s about finding a tool that effectively meets your business’s operational requirements while maximizing cost-saving opportunities.

In determining the best ways to save on business expenses while optimizing performance and convenience, we now turn our attention to the breakdown of reward programs.

Breakdown of Reward Programs

Fuel card reward programs are the cherry on top when it comes to saving money and receiving benefits while fueling up. These programs can be an excellent way to maximize discounts and receive perks based on your fuel spending. However, navigating through the different types of reward programs can sometimes feel like walking through a maze.

Some fuel cards offer tiered rebates based on the volume of fuel purchased, which means the more fuel you buy, the higher your rebate. Other cards provide a flat rebate rate on all fuel transactions, regardless of volume. Both models have their positives, so it’s essential to weigh them against your specific business needs.

For businesses with a consistent or high fuel consumption, tiered rebates might yield larger benefits because as you spend more on fuel, the rebate percentage increases significantly. This suits businesses that rely heavily on transportation and fuel for operations. In contrast, flat-rate rebate cards offer simpler and more predictable savings, which can be beneficial for smaller businesses with less predictable or fluctuating fuel expenses.

Let’s say your business needs require a relatively consistent amount of fuel each month. In this scenario, a flat rebate on all fuel transactions might be more beneficial as it offers consistency without having to worry about meeting certain thresholds to unlock higher savings.

It’s quite common to find that some fuel card reward programs also include additional benefits such as discounts on vehicle maintenance or even travel rewards in addition to fuel rebates.

Understanding these reward program intricacies is vital in making informed decisions about which fuel card will best serve your business needs and help save money where it matters most.

Now that we’ve explored maximizing discounts through rewards and rebates, it’s time to unravel the complex world of fees and eligibility rules in the next section.

Unraveling Fees and Eligibility Rules

When it comes to fuel cards, the focus isn’t solely on rewards and discounts; understanding the fees and eligibility rules is crucial. These factors can significantly impact the overall value of a fuel card. Let’s break it down.

One of the first things to consider is whether there’s an annual fee for the card. Some cards have an annual fee, which is a fixed amount you pay each year for using the card. It’s important to weigh this cost against the potential savings and benefits offered by the card. If the annual fee is high, your savings from rewards and rebates will need to significantly outweigh this cost for the card to be worthwhile.

In addition to annual fees, transaction fees are another crucial aspect to look out for. These are charges incurred every time the card is used, and they can eat into your potential savings if they’re too high. Some cards may have lower transaction fees, while others might offset them with higher overall prices at the pump.

For instance, imagine you have a fleet of vehicles and each driver uses their fuel cards multiple times a week. Even a small difference in transaction fees can add up over time and make a significant impact on your overall costs. It’s important to do the math and compare these transaction fees across different fuel card options to find the best fit for your business needs.

Now, let’s talk about eligibility rules. Different fuel cards have various rules about who can apply for them. Some might only be available to businesses with a certain number of vehicles or a minimum monthly fuel spend. It’s essential to understand these restrictions before diving in. This information helps ensure that you’re choosing a card that aligns with your business operations and won’t pose any unexpected limitations in usage.

Understanding the fee structure and eligibility rules of a fuel card program provides valuable insights into its cost-effectiveness and suitability for your business needs. By carefully considering these factors, you can make an informed decision that maximizes savings and benefits for your company.

In navigating the complex landscape of fuel cards, deciphering the finer details can lead to substantial long-term benefits for your business. Choose wisely, keeping in mind both immediate gains and future advantages.