Next to purchasing your home, buying a car is usually the most significant purchase you are likely to make. It is something that will convenience you in your daily life but it is also a big commitment. Not only do you have to fuel it up every once in a while (which can be pricey, depending on how often and how far you drive), there are also maintenance fees and insurance. So it makes sense that you should put some effort into it to make sure you end up getting value for money. That should not end with just choosing a make and model that you think offers really good value, have low maintenance or cheaper parts (in the event the car breaks down) but also is fuel-efficient. How you choose to finance that will make a big difference in the total cost of ownership. We will look at one of the most cost-effective options available, a novated lease.

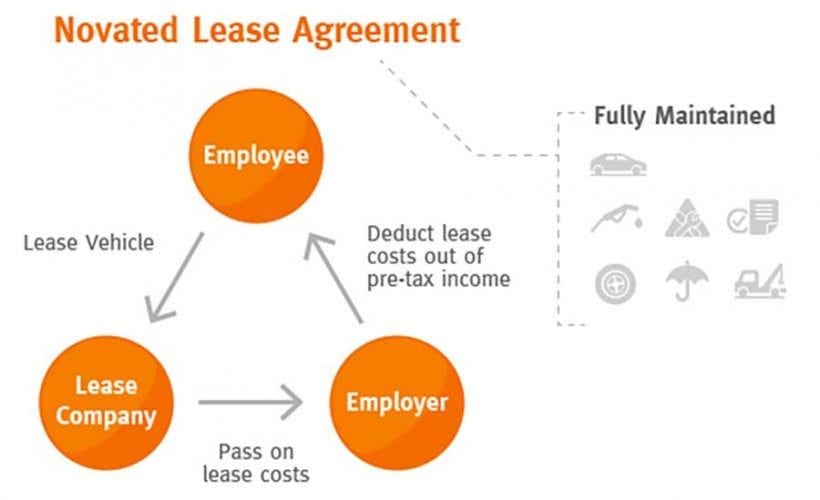

A novated lease is one that is involving three parties. The employee, the employer, and the leasing company. The way that it differs from a standard lease is that the obligation to make payments on the lease is novated from the employee to the employer. This means that the employee remains the leaseholder and any advantages in terms of owning the car at the end of the lease stay with them. There are a number of advantages to this form of leasing for both the employer and the employee.

The advantage for the employer is that the obligation only lasts as long as the employee is employed by them. If the person quits or has their employment terminated then the obligation to make the payments shift to the employee. This means you will never end up making lease payments on a car that none of your employees is using. This gives employers the kind of flexibility they need and makes it much easier for them to offer a novated lease as a fringe benefit to their employees.

While it might not cover a luxury car service like the one from the Deutsches Auto Service Centre, the advantage for the employee is that you will still have your car even if you lose your job. Since the car will stay with you after you have left the company you will generally find that employers are less restrictive on which makes and models you can select as part of a novated lease though they will likely give you a band in terms of the cost of payments that they will accept. This means it is less likely you will get stuck with some plain sedan as you would normally with a company car and can have a vehicle with a bit more personality. However, this does not mean that you should choose an ostentatious car that you would not be able to afford without your current job. As the payment falls to the employee in the event he is no longer with the company, it would be wise to choose a car that you would be able to continue paying for, or you might find yourself both carless and jobless.

Common sense aside, there are also tax advantages to a novated lease particularly in terms of GST that can significantly reduce the total cost of ownership. Since most employers are able to claim back the 10% GST payments as part of the lease there is a significant reduction in the total cost. Though things will vary depending on the exact terms of your lease and your personal tax circumstances as a general rule of thumb over the life of the lease you will be at a significant financial advantage over buying a car using a car loan or second mortgage and even be better off after tax that if you had just purchased the car using your savings. It is definitely an option you should consider for financing your car.

If your current company does not include this program, you might be able to convince them of the aforementioned benefits. Furthermore, it works out for both parties as both will be able to save on tax. How it works is that the employer will be making the payment for the car out of your pre-tax income and your income tax will be calculated based on your newly adjusted income. How does this benefit the employer? For one thing, a happy employee equates better loyalty to the company and more often than not, boosts productivity, and why not at no extra cost to the employer? This would also entice new talents to come work for your company because it is an attractive idea whereby the employee is able to not only choose the vehicle they would like but also has the choice to upgrade their car to a different size, model or brand.

Of course, there are always two sides to a coin. If you do lose your job or resign from it, you might need to find a new job with an employer who is willing to take over the novated lease or you might have to terminate it and pay out the remaining balance, on top of additional charges. Speaking of additional charges, there are certain administrative fees that come with these leases. Therefore, you will most likely be paying a much higher interest rate than you would if you have taken out a car loan instead.

Before you jump at what looks like a win-win situation, you do need to do a little research for yourself as not everyone would be able to reap the maximum benefits of this program. If you really want to get into the nitty-gritty of it, it’s best to use a calculator to help you determine whether it is in your best interest to finance your car using a novated lease or if you should go about it the traditional way. Speaking with your accountant could greatly benefit you as they will look at your current tax levels to determine whether this is what you should do.