Many people perceive their four-wheelers as another member of the family, so buying a vehicle is one of the most important decisions to make. One of the main questions that arise when there’s a need for a new car is whether to buy a new or a used one?

It is important to know at the outset that no decision is wrong, but that there are reasons why either of these two choices may be more favorable or unfavorable for you. However, there are situations such as those when you need to get a loan in order to buy one when it’s easy to get stuck – especially if your credit history isn’t so good.

Having a car is a necessity today, so not buying one in most cases is not an option. But worry no further, there’s an option for buying one even in your case. You may not be able to buy a brand-new car, but a used one you can find quite easy, because there are dealers who not only sell used cars but also offer the possibility of a loan. These dealers have thought of a way to combine services and make an offer for targeting people just like you. Because, let’s face it, with a financial situation anywhere in the world being like this, more and more people are struggling with their credit history.

Such services are also perfect for people who have lost their job and are now unemployed. In fact, they are perfect for anyone who cannot just go to the bank and get a loan to buy a car. In companies like DriveAxis you can even apply for a loan, choose the vehicle that suits you best, and have delivered at your doorstep.

There is one catch in the story, though. Since we’re not talking about banks, you can expect very different interest rates. For this reason, it is highly recommended to research different offers.

Let’s take a look at some of the perks of buying a used car with this kind of loan…

One of the risks of buying a used car is that no matter how well-preserved it is, you have no guarantee that its parts will not be prone to waste, in other words, that you will not have to spend a lot of time with a car mechanic for repairs. That is why you would have to thoroughly inspect a used car before buying it, with the help of your car mechanic. In cases when you choose to buy from companies who offer loans and cars, you get a warranty which means someone is guaranteeing the car you bought is in a good condition. And if something happened, repairs are covered by a warranty.

Saving up… Just as buying a new vehicle is safer in terms of quality, so buying a used one has the advantage in terms of savings. The calculation is quite clear – an already used car model of a certain brand will be cheaper than the same new model.

Although buying a new vehicle in most cases represents a higher cost, one of the advantages certainly is the possibility of paying in a couple of installments, just like taking out a loan to buy a new vehicle.

So, now that we have concluded that buying a car with a bad credit history is possible, taking into consideration all important pros of buying a used car, and learned that it is not such a bad idea at all, it is time to state a couple of important factors when choosing a lender to buy lend and buy from.

Things to keep in mind when choosing a lender

- Not every lender offers the type of car you want. Review the offer of a couple of different lenders and choose the one whose offer suits your needs best.

- Prices calculations, estimation of rates, and other things related to getting a loan. Before you even consider their services, you want to have clear input about what kind of interest you can expect, and what is a maximum loan they’ll give you.

- Is there a possibility to have a co-applicant and increase the loan amount, to buy a better car?

- Discounts on, let’s say, certain types of car models.

A couple of more things to consider…

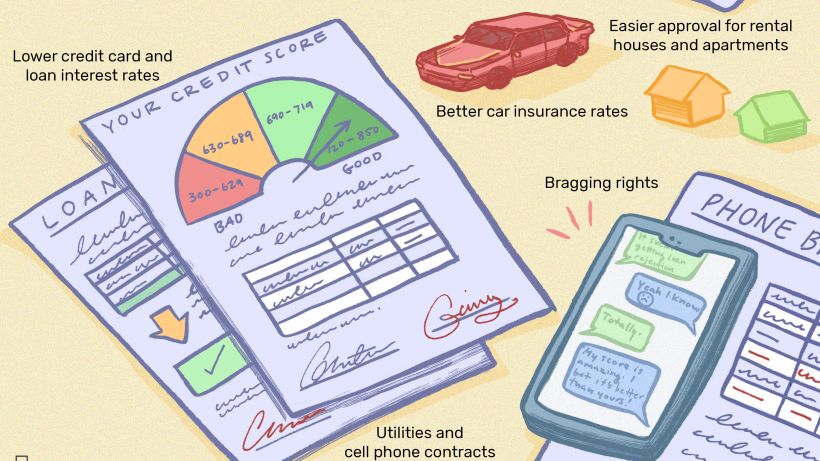

We have mentioned somewhere in the beginning how such loans are usually given with higher interests. What we also mentioned was that it is smart to consider a couple of offers before making a final decision. However, it is also important to keep in mind that positive credit history can be built again and that if you are able to wait a bit more, you might be able to apply for a loan with a lower rate.

If there is no possibility for this whatsoever, arm yourself with information about steps you can take to increase your odds of getting a better deal when it comes to a loan. Most of the dealers will offer a preapproval, based on which you will know how much they’re willing to give you.

There’s one more thing that can influence building a positive payment history, and that is returning your loan on time. As time passes and you pay everything on time, your history will no longer be bad, but grow positive. This is important because of the possibility of refinancing the current loan. When you are finally able to do this, your interest will decrease.

Keep in mind that every car dealer has one aim, to sell you a car with the highest price. And they will use every method to succeed in this. Thus, it is of great importance to know how much you can stretch, not to go over your throat in debt. Count on some extra expenses you will have to pay for as well, like insurance, taxes, gas, registration. Calculate how much you can afford to pay on a monthly basis and you’ll be ok.