In 2025, being a carmaker means more than building wheels and selling metal. Shareholders are no longer satisfied with volume, market share, or legacy balance sheet metrics alone. They now want evidence: evidence that their capital is planted in a vehicle that can transform, sustain, and lead. The core ask returns, still holds. But today it’s encrypted behind layers of expectation: from carbon footprints to governance talent, from resilient supply chains to digital strategy.

In this evolving ecosystem, investors judge automakers less by horsepower specs and more by strategic horsepower, how fluidly leadership adapts to disruption, how decisively it reins in risks, and how boldly it builds future optionality. Yes, quarterly profits still matter. But climate credibility, board accountability, and a compelling narrative of where the brand is headed in a mobility future ruled by software, battery economics, and regulation matter as much.

This isn’t hyperbole. Proxy statements in 2025 are flooded with proposals on climate risk, executive compensation, and board structure. ESG mandates tighten. Boardroom shake-ups proliferate. The message is clear: shareholders are raising the bar, and successful automakers will be those who don’t see investor expectations as a hurdle, but as a competitive edge.

Reading the Room ─ From Dividends to Direction

Picture this ─ you’re a large institutional investor, maybe a sovereign fund or endowment. You’ve held shares in a legacy auto company for years because it reliably refreshes models, expands into new markets, marginally raises margins, and pays dividends. But in 2025, you’re filtering opportunities through a different lens.

Your demands now include:

- Sustainable profits over one-off windfalls. You’re assessing returns not for the next quarter, but the next decade.

- Credible ESG commitments, not PR posturing. You want to see real metrics, not vague pledges.

- Governance that mitigates risk and accelerates innovation. You expect the board to walk the tightrope.

- Adaptive strategy in a fast-shifting mobility landscape. From subscription models to autonomy, flexibility is nonnegotiable.

- Trustworthy communication, no surprises. You don’t want to be blindsided by supply shocks, recalls, or pivot announcements.

In other words, your capital should sit in a business that can evolve, not plateau.

This shift is real. In 2025’s proxy season, climate-related proposals, revisions to executive pay, and demands over board composition top agendas. Meanwhile, the automotive sector ranks lowest in the “Trust & Like Score” among consumer-facing industries, highlighting fragility in stakeholder confidence.

One critical lever: placing independent voices in governance roles that resonate with investor concerns. That’s why a non-executive director recruitment agency becomes instrumental, helping carmakers bring in independent voices who bridge capital markets, technology, sustainability, and fiduciary oversight.

Financial Discipline in a Low-Growth World

Market headwinds are real. Global auto sales in 2025 are forecast to rise a modest 1.7 %, reaching ~89.6 million units. Some analysts even project slower growth, closer to ~1 %. In this context, investors expect more than top-line growth, they expect surgical capital deployment.

Key expectations:

- Disciplined capital allocation. No chasing prestige M&A without clear return justification.

- Organic growth vectors. Focus on aftermarket services, software, recurring revenue.

- Cost rigor. With tariffs, inflation, and supply volatility in play, cost control becomes structural. U.S. input tariffs, for example, are estimated to raise vehicle cost by 10–15 %.

Increasingly, investors view automakers more like platform businesses: the ones who master software, subscription monetization, and high-margin recurring revenue will command premium valuations.

The Green Premium Must Close, and Credibly

ESG is no longer sideline theater. Shareholders demand:

- Real emissions reduction across Scope 1, 2, and 3—not just glossy targets.

- Alignment of electrification strategy with infrastructure realities (charging access, grid load).

- Transparency on trade-offs: battery sourcing, recycling, and social impact in supply chains.

A compelling insight: a study of Chinese auto firms shows that entrepreneurial ambition positively correlates with ESG performance, mediated through innovation capability and competitive pressure. In other words, ESG shouldn’t be a cost center; it should fuel competitive differentiation.

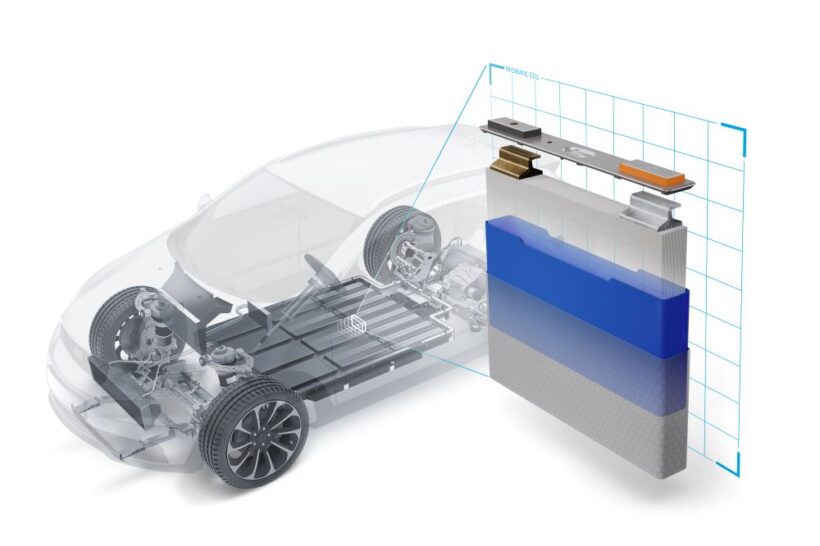

Another layer: shareholders want clear plans for cost parity between EVs and ICE vehicles. According to modeling in China’s market, short-range EVs may achieve acquisition-cost parity by 2025, with long-range variants following later.

The Non-Financial Battleground ─ Governance, Trust & Transparency

Even a company with strong financials can lose credibility through poor governance or opacity. In 2025, those weaknesses are existential.

Board Strength and Proactive Oversight

Modern shareholders expect boards that do more than rubber-stamp. They expect:

- Deep domain fluency in software, regulation, climate, and capital markets

- The capacity to challenge management constructively

- Independent directors who relate strategy to accountability

That’s another moment for a non-executive director recruitment agency to shine, finding voices who can act as strategic filters between operations and capital markets.

As proof points: 2025 proxy data shows S&P 500 companies receiving an average of 2.2 shareholder proposals, many aimed at board structure, pay, and climate risk. A lax board becomes a target.

Narrative, Transparency, and Converting Trust Capital

Historically, automakers have used opacity to insulate long development cycles. That buffer is evaporating.

Investors now expect:

- Frequent, honest disclosures of risks (commodity swings, supply chain shocks)

- Roadmaps for sustainability with progress metrics

- Early alerts for strategic pivots or structural shifts

- Integrated mission-level narrative linking mobility, urban growth, and climate

If you tell “where we are, where we’re going, and how we measure success,” you transform shareholders into partners, not watchdogs.

The Expectations Are Tougher – But the Upside is Richer

Shareholders in 2025 are neither naive nor sentimental. They know full well the automotive industry is capital-intensive, complex, and in the throes of transformation. What they demand is proof: proof you can manage disruption, deliver returns, evolve your identity, and do all that with integrity.

If your board is proactive, your metrics forward-looking, your capital allocation disciplined, your narrative authentic, and your governance tight, you won’t just keep shareholder trust, you’ll become the auto leader investors are proud to back.