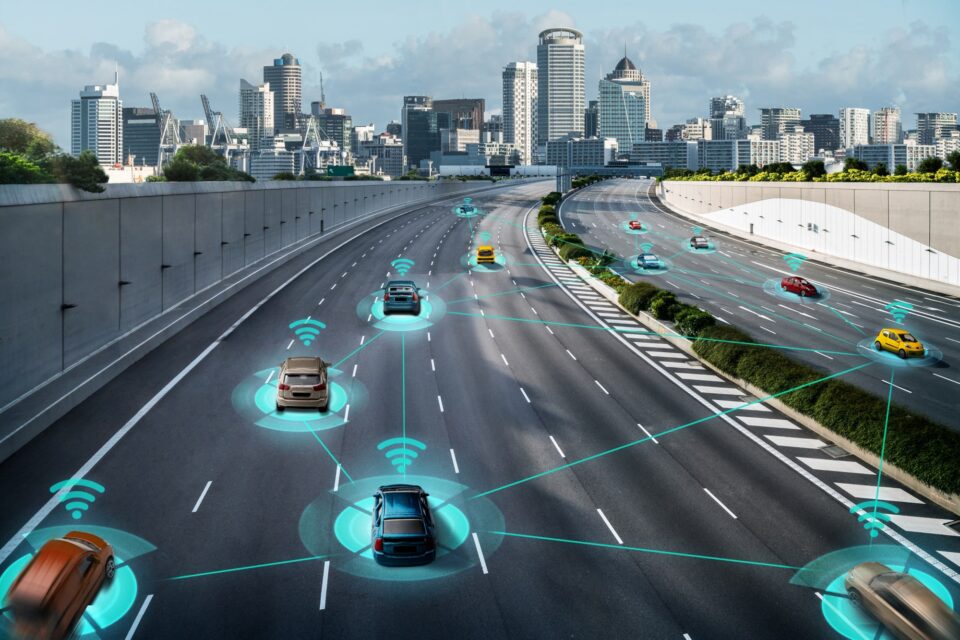

In the swiftly evolving landscape of automotive technology, the convergence of smart driving features and connected vehicles is not merely a technological trend but a profound paradigm shift that extends its influence into the realm of auto insurance. As cars become more connected, equipped with a myriad of advanced technologies, the traditional approach to insuring vehicles is undergoing a metamorphosis.

Gone are the days when insurance was a static product, based on historical data and generalized risk assessments. Today, we stand at the cusp of a new era where smart driving technologies are not only reshaping how we navigate roads but are fundamentally altering the way insurance providers evaluate, price, and deliver coverage

1. The Rise of Smart Driving Technologies

Smart driving technologies encompass a wide array of features designed to enhance safety, efficiency, and overall driving experience. From advanced driver assistance systems (ADAS) to in-car connectivity, these innovations are becoming commonplace in modern vehicles.

a) Advanced Driver Assistance Systems (ADAS):

– ADAS features, such as lane-keeping assistance, adaptive cruise control, and automatic emergency braking, are not only making roads safer but are also influencing insurance risk assessment models.

b) Telematics and Data Connectivity:

– Telematics devices and integrated connectivity provide real-time data on driving behavior. From tracking acceleration patterns to monitoring braking habits, insurers are leveraging this data to tailor coverage based on individual driving habits.

2. Personalized Policies through Telematics

The advent of telematics technology has ushered in a new era of personalized auto insurance policies. Rather than relying on generalized risk assessments, insurers can now craft policies tailored to an individual driver’s habits and preferences.

a) Usage-Based Insurance (UBI):

– UBI utilizes telematics data to assess risk accurately. Drivers who exhibit safe and responsible behavior may benefit from reduced premiums, creating a financial incentive for adopting smart driving practices.

b) Real-Time Monitoring and Feedback:

– Smart driving technologies allow for real-time monitoring and feedback, enabling drivers to actively engage in safer driving practices. Insurers can offer discounts or rewards for drivers who consistently exhibit responsible behavior on the road.

3. Challenges and Considerations

a) Data Privacy and Security:

The extensive collection of data from smart driving technologies raises significant concerns regarding privacy and security. As insurers rely on telematics data to personalize coverage, ensuring the confidentiality and protection of sensitive information becomes paramount. Striking the right balance between utilizing data for risk assessment and safeguarding individuals’ privacy is a complex challenge that requires robust encryption protocols, secure storage, and adherence to privacy regulations.

b) Standardization of Data:

The variety of smart driving technologies and their data formats pose a challenge for insurers seeking to integrate this information seamlessly into their risk assessment models. Standardization efforts are essential to establish uniform data formats, communication protocols, and compatibility standards across the industry. A lack of standardization can hinder efficient data exchange between insurers and vehicle manufacturers, potentially leading to delays in processing claims and assessing risks accurately.

4. The Road Ahead: Future Trends in Smart Driving and Insurance

a) Autonomous Vehicles and Insurance Implications:

The integration of autonomous vehicles into the transportation ecosystem brings forth new challenges and opportunities for the insurance industry. As these vehicles become more prevalent, insurers will need to adapt their models to account for the evolving landscape of liability. Determining responsibility and assessing risk in situations involving autonomous technology failures or accidents may require innovative coverage models that address the unique characteristics of self-driving vehicles.

b) Dynamic Risk Assessment:

Future trends in smart driving and insurance will likely include advancements in dynamic risk assessment. With real-time data streaming from connected cars, insurers can move away from traditional static risk models. Dynamic risk assessment allows for continuous monitoring of driving behavior, environmental conditions, and other factors, enabling insurers to adjust coverage and premiums in response to changing circumstances. This dynamic approach not only enhances accuracy but also reflects a more adaptive and responsive insurance framework.

Accident Prevention through Smart Driving Technologies

Smart driving technologies are ushering in a new era of accident prevention. With features like lane-keeping assistance, adaptive cruise control, and automatic emergency braking, vehicles equipped with advanced driver assistance systems (ADAS) are becoming safer than ever. These technologies not only enhance driver safety but also have a significant impact on insurance risk assessment models. By actively preventing accidents, ADAS-equipped cars reduce the frequency of claims, ultimately leading to lower insurance premiums for responsible drivers. This shift towards accident prevention represents a win-win scenario for both drivers and insurance providers, fostering safer roads and more cost-effective coverage.

Environmental Impact: Promoting Eco-Friendly Driving

In addition to accident prevention, smart driving technologies play a pivotal role in promoting eco-friendly driving habits. Telematics and data connectivity allow insurers to monitor driving behavior in real-time, providing an avenue to encourage environmentally responsible practices. Drivers who adopt fuel-efficient driving habits, such as smooth acceleration and braking, can benefit from reduced premiums, creating a financial incentive for reducing their carbon footprint. By aligning insurance policies with eco-friendly practices, the insurance industry contributes to a greener future while rewarding responsible drivers who prioritize sustainability.

End Note

In conclusion, the intersection of technology and auto insurance heralds a transformative era in the way we approach coverage and risk assessment. The challenges presented by data privacy, security concerns, and the need for standardization underscore the importance of careful navigation in this evolving landscape.

As smart driving technologies continue to mature and become integral to our daily lives, the insurance industry must embrace innovation while addressing these challenges. Striking a harmonious balance between leveraging data for personalized coverage and safeguarding privacy is crucial for building trust among consumers and ensuring the sustained success of this symbiotic relationship.

The road ahead involves not just overcoming challenges but also capitalizing on opportunities. The evolution toward autonomous vehicles and the adoption of dynamic risk assessment signal a future where insurance becomes more adaptive, responsive, and tailored to individual needs. Ultimately, the synergy between smart driving and insurance isn’t just about mitigating risks – it’s about creating a safer, more connected, and efficient driving experience for all. By navigating these challenges thoughtfully, the industry can steer towards a future where smart coverage becomes an integral part of our intelligent and interconnected transportation ecosystem.