In the ever-evolving landscape of automotive technology, advancements focus on preventing accidents and streamlining the processes that follow. The aftermath of a car accident often involves navigating complex insurance claims, a task that has traditionally been cumbersome and time-consuming.

However, with the integration of modern car tech, particularly telematics and onboard diagnostics, the insurance claims process is undergoing a revolutionary transformation.

In this article, we will delve into how car technology simplifies insurance claims after accidents, exploring the impact of data-driven insights and emerging technologies in creating a more efficient and transparent claims experience for insurers and drivers.

The Rise of Telematics in Insurance Claims

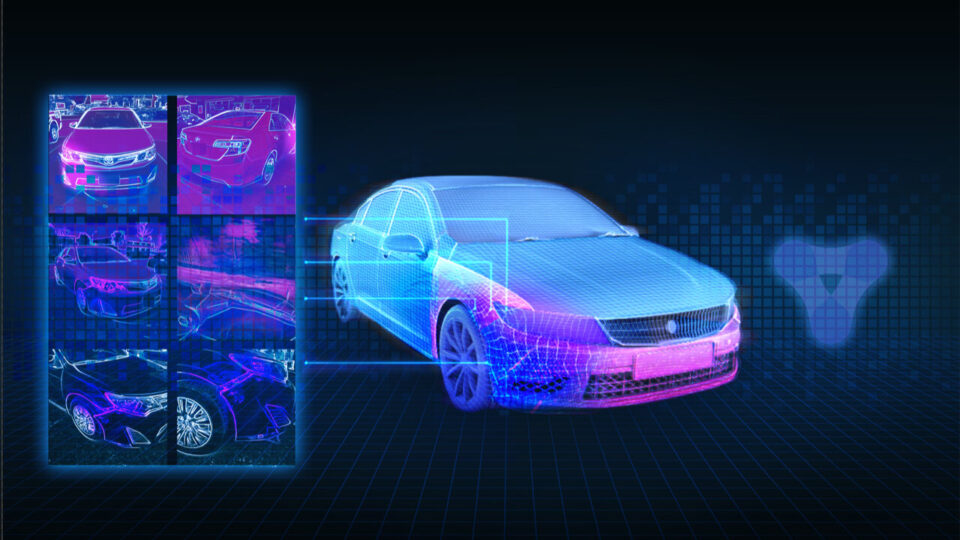

Telematics, a combination of telecommunications and informatics, plays a pivotal role in reshaping the insurance landscape.

When installed in modern vehicles, telematics systems can collect and transmit real-time driving behavior, vehicle performance, and location data. Insurance companies are increasingly leveraging this wealth of information to gain insights into the circumstances surrounding accidents.

One significant advantage of telematics is its ability to provide accurate and unbiased data about the events leading up to an accident. GPS tracking, for instance, offers precise information on the vehicle’s location and speed, helping insurers reconstruct the sequence of events. This not only expedites the claims process but also reduces disputes regarding the details of an accident.

Onboard Diagnostics

Onboard diagnostics (OBD) is another critical component of modern car tech that contributes to simplifying insurance claims. OBD systems monitor the health of a vehicle’s various components and can detect issues related to engine performance, emissions, and more. In the aftermath of an accident, this technology becomes instrumental in assessing the extent of damage and understanding the impact on the vehicle’s functionality.

Insurance claims often involve thorough inspections to determine the cause and scope of damage. OBD systems streamline this process by providing detailed diagnostics data, enabling insurance assessors to identify the specific areas affected and assess the cost of repairs more accurately. This speeds up the claims process and ensures a fair and transparent evaluation of the damage.

Data-Driven Claims Processing

The integration of telematics and OBD in the insurance claims process leads to a paradigm shift towards data-driven claims processing.

The traditional methods of relying on subjective accounts and external assessments are being replaced by a more objective and technology-driven approach. This data-driven approach will help expedite your claim processing so that you don’t have to worry about running into the statute of limitations, which can vary from state to state.

Combined with information from OBD systems, telematics data creates a comprehensive dataset that insurers can analyze to understand an accident’s dynamics better.

Algorithms can assess the severity of impacts, evaluate the probability of injuries, and estimate repair costs based on real-time data. This level of automation reduces the time required for claims processing and minimizes the potential for human errors in assessment.

Immediate Reporting and Automatic Crash Notification (ACN)

One of the critical aspects of post-accident response is the time it takes to initiate emergency services and assess the situation. Modern car tech addresses this concern through features like Automatic Crash Notification (ACN), which automatically alerts emergency services when a significant collision occurs.

ACN relies on sensors within the vehicle to detect sudden changes in speed and direction indicative of a crash. Once triggered, it initiates an immediate notification to emergency services, providing them with crucial information such as the vehicle’s location and the severity of the impact.

This swift response can be life-saving in critical situations and significantly reduces the time it takes for assistance to reach the accident site.

Knowing Your Rights in a Car Accident

While modern car tech significantly improves the efficiency of insurance claims after accidents, it’s crucial for drivers to be aware of their rights in the aftermath of a collision. Understanding your rights empowers you to navigate the post-accident process confidently and ensures fair treatment. Key considerations include:

Right to Medical Treatment: Regardless of fault, you have the right to seek medical attention for any injuries sustained in the accident. Prompt medical care prioritizes your well-being and establishes a record of injuries for potential insurance claims.

Right to Choose Your Repair Shop: In many jurisdictions, you have the right to choose where your vehicle gets repaired. Insurers may provide recommendations, but you are not obligated to use a specific repair shop.

Right to Legal Representation: If the accident involves complexities or disputes, you have the right to seek legal representation. An attorney can help protect your rights, negotiate with insurers, and ensure you receive fair compensation.

Right to a Fair Settlement: Insurance companies are obligated to handle claims in good faith. You have the right to a fair and timely settlement that adequately covers your damages, including medical expenses, vehicle repairs, and other associated costs.

Knowing your rights provides a foundation for asserting yourself during claims and helps prevent potential injustices. It’s advisable to familiarize yourself with local laws and regulations to navigate the aftermath of an accident knowledgeably and confidently.

Challenges and Future Prospects

While integrating modern car tech into insurance claims processes brings numerous benefits, it is not without its challenges.

Privacy concerns regarding collecting and using personal driving data remain a significant issue. Striking the right balance between leveraging data for claims processing and respecting the privacy of individuals is crucial for the widespread acceptance of these technologies.

The future of insurance claims processing seems poised for further innovation. Advancements in artificial intelligence (AI) and machine learning (ML) are likely to play a more prominent role in automating claims assessment, predicting risk factors, and personalizing insurance premiums based on individual driving behavior.

Modern car tech is undeniably transforming the way insurance claims are handled after accidents, offering a more streamlined, efficient, and transparent process.

Telematics, onboard diagnostics, automatic crash notification, and blockchain technology are collectively reshaping the insurance landscape, ushering in an era where data-driven insights and automation enhance the overall claims experience.

As the automotive industry continues to embrace technological advancements, the journey towards a seamless and tech-driven insurance claims process unfolds, promising benefits for insurers, drivers, and the industry as a whole.